Keegan O’Toole, WCED Intern

Financial Technology, better known as “Fintech” is one of the most rapidly growing sectors of the information technology industry. This sector emerges from the integration of technology with traditional financial services. Improvements in cybersecurity, data analytics, and software platforms mixed with new demands from the consumer have called for more advanced, efficient and streamlined financial services and solutions.

Whether purchasing coffee at your local coffee shop or managing your finances through your phone, you are utilizing the financial tech industry. Fintech has been used for many of the newest technological developments, from payment apps like PayPal, Zelle, Venmo to even cryptocurrency.

The tools provided by Fintech are changing the way many consumers track, manage and facilitate their finances. In fact, according to data from 2016, people use between one and three apps to manage their finances.

In an effort to better understand and promote the region’s local Fintech ecosystem, Wake County Economic Development partnered with RTI International to perform an industry analysis of the sector. The goals of the study were to:

- Define the Fintech sector and develop a structural framework of the ecosystem

- Develop a database of existing Fintech companies in the region

- Identify the Triangle’s assets, strengths, and opportunities for growth within the sector

- Communicate the Triangle’s competitive advantage in Financial Technology

To achieve these goals, the project team analyzed and identified high-level trends in industry and innovation data for the region including patenting, venture capital, occupation, educational attainment, and NAICS code data.

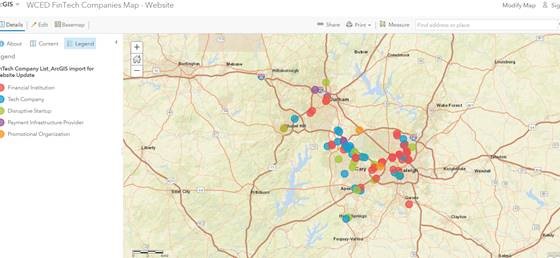

The following link provides an interactive map of companies identified as being within the Fintech ecosystem in the Research Triangle. Companies fall within the categories of financial institutions, tech companies, disruptors, payment infrastructure providers, and promotional organizations. It is important to note that not all of these companies can be considered “true Fintechs” but still play an essential role in the growth of this sector.

*Fintech companies in Wake County

As a world-class tech hub, the Research Triangle’s close proximity to major financial markets positions our region as a provider of back office, business-to-business Fintech solutions for the financial service industry. Large tech companies like IBM, SAS, and RedHat are innovating in software development, AI machine learning, and data analytics while traditional financial service institutions are adopting these solutions.

Michael Hogan, team lead for RTI, explains the shifts in the financial services industry, nationally;

“Tech jobs have been the fastest growing occupation in the banking industry for the past decade, and there is an emerging ecosystem of disruptive startups, and tech companies providing services to traditional financial firms. This change in traditional financial services is driven by consumer and business demands for a lower cost and more efficient way to manage their money.”

This emerging trend provides an opportunity for Wake County and the region to become a leader in financial technology. With an established pipeline of highly educated talent, a strong presence of technology companies in the region, and a low cost of doing business, we are well positioned to attract more Fintech companies to the region, and promote growth within our existing companies and disruptive startups.

For more information regarding Fintech, read our Fintech target industry page on our website or contact Kathleen Henry.

Comments

There are no comments yet.

Leave a Comment