What are Opportunity Zones?

The Opportunity Zones incentive is a new community investment tool established by Congress in the Tax Cuts & Jobs Act of 2017 to encourage long-term investments in low-income urban and rural communities nationwide. Opportunity Zones (OZ’s) will provide a tax incentive for investors to re-invest their unrealized capital gains into dedicated Opportunity Funds.

Opportunity Zones in Wake County and North Carolina

In 2018, Wake County leadership and partners met to discuss the nominations of census tracts. The North Carolina Department of Commerce provided a set of guidelines and criteria for a census tract to be designated an Opportunity Zone. In North Carolina, there were approximately 252 census tracts nominated as potential zones. The N.C. Department of Commerce requested information that met the same poverty and income qualifications for eligibility as the New Markets Tax Credits. Other criteria included data from the 2011-2015 Census American Community Survey, and required that each tract met one of the two:

- Median Family Income at or below 80% of Area Median Income (AMI) in the period of 2011-2015; or

- Poverty Rate of 20% or greater in the period of 2011-2015.

According to federal law, North Carolina followed the following guiding selection principles:

- An open submission process: Solicit tract and program recommendations through N.C. Commerce’s website and direct outreach.

- Opportunity for all: Aim for at least one Opportunity Zone in every county.

- Accommodate as many submissions as possible: Aim to allow each county 25% of their total low-income tracts.

- Prioritize local recommendations and development goals.

- Prioritize state industrial site development initiatives.

Out of the 1,000 submitted census tracts, there were 252 selected across the state and Wake County designated 13 tracts as Opportunity Zones (Wake County & City of Raleigh resources linked at bottom of page).

As a whole, these tracts represented:

- A total population over 1.1 million people:

- Nearly 45,000 families with children in poverty:

- Over 50,000 business establishments: and

- Over $580 million in received public and private investments over the past 5 years.

Opportunity Zones Background

Through the 2017 Tax Cuts and Jobs Act, Opportunity Funds were designed to spur investment in distressed communities throughout the country through tax benefits. Under a nomination process completed in June, 8, 2018 - 761 communities in all 50 states, the District of Columbia and five U.S. territories were designated as qualified Opportunity Zones. Opportunity Zones retain their designation for 10 years. Investors may defer tax on almost any capital gain up to Dec. 31, 2026 by making an appropriate investment in a zone, making an election after December 21, 2017, and meeting other requirements. In October, the U.S. Department of the Treasury and the IRS released proposed regulations on Opportunity Zones designed to incentivize investment in American communities. The Treasury Department plans on issuing additional guidance before the end of the year after notice and comment.

How It Works: Basics of Tax Benefits

- Temporary Deferral: A temporary deferral of inclusion in taxable income for capital gains reinvested into an Opportunity Fund. The deferred gain must be recognized on the earlier date on which the opportunity zone investment is sold/exchanged or December 31, 2026 (whichever comes first).

- Step-Up In Basis: A step-up in basis for capital gains reinvested in an Opportunity Fund. The basis is increased by 10% if the investment in the Opportunity Fund is held by the taxpayer for at least 5 years and by an additional 5% if held for at least 7 years, thereby excluding up to 15% of the original gain from taxation.

- Permanent Exclusion: A permanent exclusion from taxable income of capital gains from the sale or exchange of an investment in an Opportunity Fund if the investment is held for at least 10 years. This exclusion only applies to gains accrued after an investment in an Opportunity Fund (they do not pay any taxes on the appreciation of that property when they sell it).

The Joint Committee on Taxation (JCT) estimates the Opportunity Zones program will cost $1.6 billion between 2018 and 2027. The program is estimated to decrease revenue between 2018 and 2025 but generate revenue in 2026 and 2027, as investors can no longer defer taxes on the capital gains they reinvested in Qualified Opportunity Funds.

To qualify as an eligible Opportunity Zone Business, a business must demonstrate that substantially all its tangible business property is located within a Qualified Opportunity Zone. No such stipulations have been made regarding the service area of the Opportunity Zone Business in the statute, but this may nonetheless be an item that the IRS chooses to address in future guidance or regulations. To learn more about the tax incentive program, you can read this fact sheet.

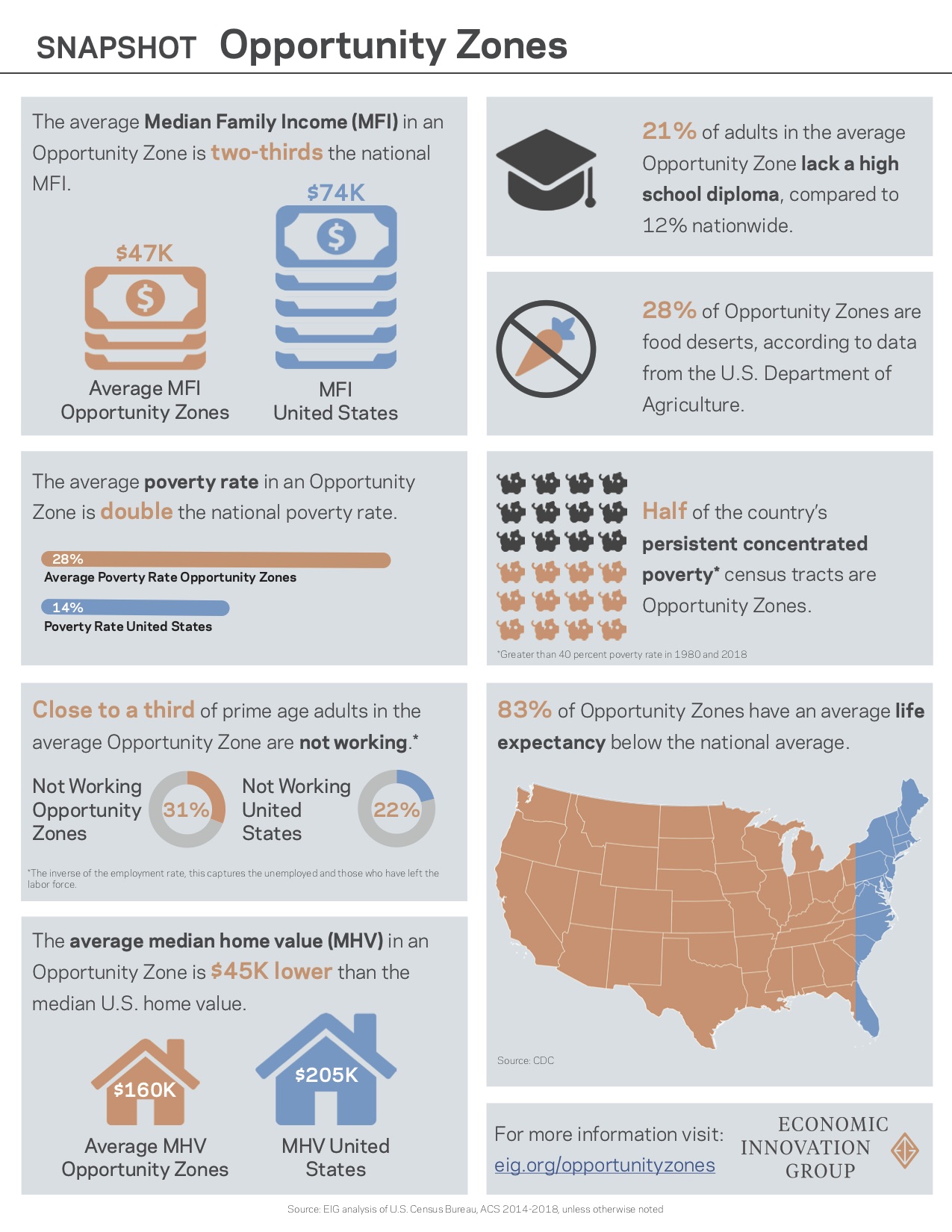

NATIONAL SNAPSHOT OF OPPORTUNITY ZONES

Opportunity Zones: Inclusive Prosperity & Place-Based Strategies

The utilization of Opportunity Zones is a place-based strategy to subsidize firm or investors who operate in specific areas. In Wake County, the purpose and intent will be to revitalize economically depressed communities. The strategy (if given the opportunity to engage investors) should address some of the components of our vulnerable communities – which include a mixture of high unemployment, population decline, vacant buildings, or residents with low income or low education levels.

Similar to Enterprise Zones, regulations SHOULD require qualifying firms or investors to create a specified number of jobs or maintain a certain level of wages for residents within the zone. The “spatial mismatch” theory argues people can become trapped in low-income areas for several reasons, such as an inability to incur the cost of moving to and living in a more productive area. In theory, place-based incentives can draw investment that will generate employment opportunities for immobile residents.

Some programs also provide benefits like workforce development within these areas. Several theoretical rationales underpin these programs. First, the cost of doing business in economically distressed areas is higher for several reasons, including less access to skilled labor and transportation, as well as higher crime. Theoretically, subsidies offered by place-based incentive programs can offset these costs and encourage businesses to locate in distressed areas.

Once can expect a broad range of investor return expectations. On one end of the spectrum, Opportunity Zones may raise capital from socially responsible, high net worth investors that would otherwise be contributing to donor-advised funds with a principal preservation focus and a low return expectation (e.g., less than 5%). On the other end of the spectrum are private equity fund investors that are expecting double digit returns based on the risk of providing equity capital to real estate or business investments. In the middle are preferred equity investment models with 6-10% annualized return expectations.

**Most of this information and research was pulled from the NC Department of Commerce. You can visit their website to learn more here.

Resources

Local

- NC Opportunity Zones Program

- Wake County Social Equity Mapping Tool

- City of Raleigh: Opportunity Zones Interactive Map

- City of Raleigh: Opportunity Zones Resource Page

- Research Triangle Regional Partnership

National

- S. Department of Treasury Opportunity Zones Resources

- Opportunity Zones Frequently Asked Questions – Internal Revenue Service

- Economic Innovation Group’s Opportunity Zones Fact Sheet

Articles

- What You Need to Know About Opportunity Zones | Forbes

- Investors Reexamine Opportunity Zones in Light of Pandemic, Protests | Co Star

- Creating Opportunity for All | The Hill

- US Opportunity Zones: Incredible Tax Savings for Entrepreneurs? | Forbes